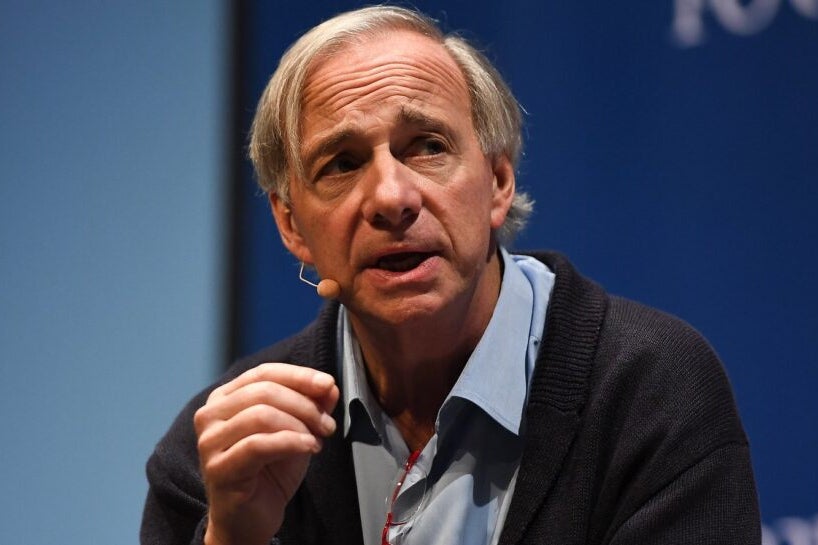

Ray Dalio's Debt Crisis Warning: U.S. On Brink?

Is the United States hurtling towards a financial crisis, a potential "economic heart attack" as some experts warn? The chorus of concern is growing louder, with prominent figures like Ray Dalio, founder of Bridgewater Associates, sounding the alarm about unsustainable debt levels and the need for urgent fiscal reforms.

The warning signs are flashing across the economic landscape. Mounting government debt, coupled with persistent deficits and evolving geopolitical dynamics, has spurred a wave of unease amongst investors and analysts alike. The potential consequences, as Dalio and others suggest, are far-reaching, potentially disrupting the global economy and impacting individuals and institutions worldwide.

| Ray Dalio - Key Information |

|---|

| Full Name: Raymond Thomas Dalio |

| Born: August 8, 1949 (age 74) |

| Nationality: American |

| Occupation: Investor, Hedge Fund Manager, Author |

| Known For: Founder of Bridgewater Associates, one of the world's largest hedge funds; Author of "Principles" |

Education:

|

Notable Achievements:

|

| Source: Bridgewater Associates Official Website |

Ray Dalio, a figure whose insights often shape the market's perception, is particularly concerned. In interviews and public statements, Dalio has reiterated his worry that the U.S. is on a dangerous trajectory. He compares the current situation to past systemic shocks, citing President Nixons abandonment of the gold standard as a pivotal moment. The implications of excessive debt accumulation are serious; as Dalio warns, this could trigger "shocking developments" within the coming years, specifically, possibly leading to an "economic heart attack" in as little as three years, if the U.S. does not take urgent action.

In an interview on NBC News' Meet the Press, Dalio highlighted the interconnectedness of various economic and political concerns, including tariffs, increasing debt, and geopolitical tensions. He emphasized the necessity of addressing these issues comprehensively, asserting that neglecting them could lead to profound disruptions across the global economy. The focus on deficit reduction, a central theme in Dalio's warnings, reflects a broader call for fiscal responsibility amid growing financial fragility. Reducing the deficit to 3% of GDP is one crucial step that Dalio and others are advising the U.S. government to take as soon as possible.

The crux of Dalio's concern lies in the unsustainable nature of the current fiscal path. He acknowledges the existence of "too much debt" being produced at a rapid pace, adding to the already massive U.S. national debt, which has now exceeded $36 trillion, with further increases expected in coming years. This unprecedented level of borrowing raises questions about the long-term health of the U.S. economy and the global financial system.

Dalio is also worried about the potential impact on the value of the U.S. dollar. He believes that various factors, including the rising debt levels, may cause a devaluation of all currencies, with certain assets like Bitcoin and gold potentially serving as safe havens during economic instability. This highlights his broader view of the financial landscape, encompassing the evolving role of alternative currencies in the face of traditional financial challenges.

Dalio's perspective is colored by his analysis of historical patterns. He draws parallels between todays risks and critical historical events, such as the U.S.'s exit from the gold standard in 1971 and the 2008 global financial crisis. These comparisons offer a sobering view, emphasizing the potentially catastrophic consequences of neglecting fiscal prudence. Such comparisons underline the importance of learning from past financial crises to avoid repeating costly mistakes.

The concern isn't just the amount of debt, but also who's buying it. Dalio points out a situation where all three major treasury buyers foreign central banks, U.S. banks, and the Federal Reserve have simultaneously scaled back their purchases. This creates a dangerous mismatch between the supply of debt and the demand for it, increasing the likelihood of market instability. It's a situation, Dalio believes, that needs immediate attention.

Dalio emphasizes that the current situation is not beyond repair. He believes there is a "solution here" that is "doable" to address the government deficit and the impending debt crisis. His perspective is not one of doom and gloom but rather a call to action, urging policymakers to take decisive steps before it's too late. His recommendations include the need for urgent fiscal reforms, emphasizing that these reforms are crucial for averting an economic meltdown.

Others echo Dalios concerns. The combined effect of tax cuts and increased government spending, many experts say, pushes U.S. debt to unsustainable levels. This concern is further amplified by the rising interest rates and rising costs, putting added strain on the nations finances. The trajectory, they warn, could have far-reaching ramifications for investors, businesses, and the broader economy, underscoring the need for caution and proactive measures.

The core message is clear. The growing debt crisis demands immediate attention, with many experts warning of a potentially disruptive impact on the global economy. The situation necessitates urgent action, including fiscal reforms, to prevent a potential financial disaster. The warning issued by Ray Dalio, along with other experts in the financial community, serves as a crucial reminder of the critical financial challenges facing the United States.

The concerns are not merely theoretical. The warnings stem from an examination of historic debt patterns and the current financial climate. The potential for market volatility, declining currency values, and a broader economic downturn are concerns that demand attention. The emphasis on these risks highlights the necessity of proactive measures to protect the financial well-being of both the U.S. and the global economy.

In essence, Ray Dalio's warnings are a call for vigilance and action. The increasing debt levels, coupled with other economic and political concerns, have created a fragile economic environment that requires immediate steps. Whether its reducing the deficit or exploring alternative monetary solutions, the path forward demands careful planning and decisive action to avoid potential disaster. The ability of the U.S. to navigate these challenges will, to a significant degree, define its economic destiny in the coming years, and potentially, the economic trajectory of the world.

Detail Author:

- Name : Petra Rodriguez

- Username : alvena.schiller

- Email : zcassin@feil.net

- Birthdate : 2007-05-07

- Address : 7794 Aliyah Mountain West Jon, HI 39036

- Phone : 1-283-321-2332

- Company : Lakin PLC

- Job : Welder

- Bio : Atque omnis ut fuga laudantium natus et eum. Aliquid ad omnis ipsum qui nisi soluta aut. Sed doloremque tenetur ullam sit qui commodi delectus. Similique unde numquam quos aliquid earum.

Socials

twitter:

- url : https://twitter.com/dejuan.spinka

- username : dejuan.spinka

- bio : Sapiente qui cum rerum natus. Porro mollitia excepturi inventore non itaque. Mollitia molestiae sint fuga voluptatem similique.

- followers : 2987

- following : 417

tiktok:

- url : https://tiktok.com/@spinkad

- username : spinkad

- bio : Quaerat et dolore iusto enim voluptas totam debitis.

- followers : 5412

- following : 1445

instagram:

- url : https://instagram.com/spinka2000

- username : spinka2000

- bio : Repellendus quia rem fugit ut. Voluptas accusamus expedita et dignissimos veritatis.

- followers : 5344

- following : 2744

linkedin:

- url : https://linkedin.com/in/dejuan.spinka

- username : dejuan.spinka

- bio : Sit eum tenetur harum sed enim officiis.

- followers : 2610

- following : 52