Exxon Mobil (XOM) Stock: Latest News & Analysis - Is It A Buy?

Is now the right time to consider investing in Exxon Mobil (XOM), despite the recent fluctuations in the energy market? The current trading environment, coupled with Exxon Mobil's strategic moves and financial performance, presents a compelling case for potential investors to re-evaluate the company's stock.

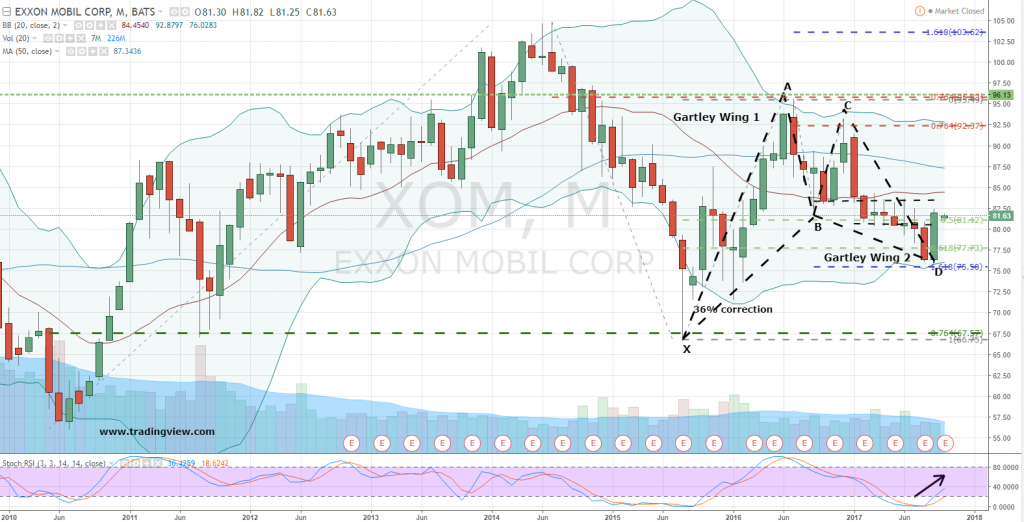

Shares of energy and petroleum stocks are currently navigating a period of downward pressure, a trend that merits closer examination. This situation, compounded by the broader economic landscape, necessitates a deeper dive into the factors influencing Exxon Mobil's (XOM) performance. While the market presents challenges, understanding these dynamics is crucial for making informed investment decisions. One must assess the latest analyst estimates, including earnings and revenue forecasts, earnings per share (EPS) projections, and any recent upgrades or downgrades, to gauge the company's future prospects. Interactive charts, readily available, offer a wealth of data, enabling investors to analyze trends and make informed decisions. Tracking the price, historical values, financial information, and price forecasts is essential to understanding the stock's journey. Furthermore, keeping abreast of news, investor discussions, and expert opinions can provide valuable insights into market sentiment and potential opportunities.

Exxon Mobil's Q4'24 earnings and Free Cash Flow (FCF) were particularly robust, largely driven by the enhanced production capabilities derived from the acquisition of Pioneer Natural Resources. This strategic move underscores the company's commitment to growth and shareholder value. This acquisition also signifies a forward-thinking approach, positioning Exxon Mobil to capitalize on future opportunities in the energy market. The dividend increases are a direct reflection of the company's financial health and its dedication to rewarding shareholders, solidifying its reputation for consistent returns.

- Movierulz 2025 Latest Telugu South Indian Movies More

- Is Hdhub4u Safe Latest Movies Updates Alternatives

The information pertaining to the core of the topic is given below:

| Aspect | Details |

|---|---|

| Company Name | Exxon Mobil Corporation (XOM) |

| Industry | Oil and Gas |

| Stock Exchange | NYSE (XOM) |

| Key Metrics | Price, Historical Values, Financial Information, Price Forecast, Earnings, Revenue, EPS, Dividends, etc. |

| Recent Events | Q4'24 Earnings, Pioneer Natural Resources Acquisition, Dividend Increases |

| Market Sentiment | Analysts' Ratings (Buy/Strong Buy), Investor Discussions |

| Challenges & Opportunities | Oil Market Challenges, CO2 Storage Agreements, Growth and Income Strategy |

| Price Information | Trading Price, Price History, Recent Fluctuations |

| Analyst Expectations | Quarterly Earnings Forecasts |

| Shareholder Returns | Dividend Increases, Total Shareholder Returns |

| Trading Resources | Yahoo Finance, MSN Money, Nasdaq, WSJ |

| Additional Details | Oil market challenges, co2 storage agreements and growth and income strategy. |

Reference: ExxonMobil Official Website

The market's current valuation of Exxon Mobil appears to reflect the positive outcomes of its growth and income strategy. This strategy, which encompasses strategic acquisitions, operational efficiencies, and a focus on shareholder returns, is designed to drive long-term value creation.

- Yourina Yourina Content News Leaks Community Updates

- Hdhub4u Movies Series Watch Download Hindi English More

The stock's performance since the start of the year, when it was trading at $107.57, and its recent movement to $106.20, representing a 1.3% decrease, highlight the dynamic nature of the market and the factors impacting Exxon Mobil's valuation. Investors and analysts closely monitor these fluctuations, as they can signal potential buying opportunities or areas of concern. The recent trading session's close at $108.63, a +0.06% increase from the previous day, showcases the day-to-day volatility.

The oil and gas sector, while historically undervalued, is on the cusp of significant developments. Despite short-term hurdles, the long-term prospects remain promising, particularly for well-positioned companies like Exxon Mobil. Recent challenges in the oil market and considerations regarding CO2 storage agreements present both challenges and opportunities. The company's ability to navigate these complex issues will be crucial in determining its future success.

It is important to note that whenever XOM experiences a decline of up to 5%, investors tend to show an increased appetite for the stock, viewing it as a buying opportunity. The historical trends can suggest a level of resilience and investor confidence in the company's long-term prospects. The analysts' expectation for quarterly earnings of $1.70 provides a useful benchmark for evaluating the company's financial health and progress.

The companys continuous focus on rewarding shareholders with dividend increases is a significant factor. This action strengthens the companys attractiveness for long-term investors. The commitment to returns is a sign of financial stability and management confidence.

The latest information on XOM stock is available through various sources, including financial news outlets, investor forums, and company filings. These resources offer access to the latest quotes, historical data, news, and other crucial information needed for trading and investment decisions. Accessing information from reputable sources ensures investors have access to the most up-to-date insights.

The energy market is dynamic. Stay informed about the ongoing developments and strategic moves of Exxon Mobil to make informed investment decisions. The company's adaptation and resilience in the face of market dynamics will determine its long-term value. It is essential to analyze the company's performance metrics, evaluate the broader market context, and use all available resources.

The strategic focus on growth, income, and shareholder returns, combined with its resilience in the face of market challenges, positions Exxon Mobil as a key player in the energy sector. This combination warrants a thorough examination for anyone considering an investment in the energy market. For more detailed investment decisions, its essential to continue to review financial information and analyst recommendations.

Detail Author:

- Name : Mr. Angus Breitenberg

- Username : rohan.justice

- Email : oleta79@shields.com

- Birthdate : 1974-11-18

- Address : 512 Tromp Stravenue New Cayla, OK 09415-0050

- Phone : 1-484-528-5612

- Company : Turcotte, Hettinger and Ullrich

- Job : Mathematical Scientist

- Bio : Vero optio qui non tenetur iusto. Laboriosam et dolorum illum quas commodi quod ipsam. Soluta ullam mollitia nihil aut et.

Socials

facebook:

- url : https://facebook.com/wintheiserd

- username : wintheiserd

- bio : Quibusdam aut facere enim quasi eligendi.

- followers : 2133

- following : 1707

linkedin:

- url : https://linkedin.com/in/wintheiserd

- username : wintheiserd

- bio : Unde quo molestias qui ut ut saepe.

- followers : 6308

- following : 2117

tiktok:

- url : https://tiktok.com/@dinawintheiser

- username : dinawintheiser

- bio : Quidem cum inventore quis tenetur. Sunt qui qui magni enim laboriosam dolore.

- followers : 112

- following : 209

instagram:

- url : https://instagram.com/dwintheiser

- username : dwintheiser

- bio : Deserunt ea molestiae placeat temporibus. Modi ex et consequatur dolore velit et.

- followers : 2082

- following : 552

twitter:

- url : https://twitter.com/dwintheiser

- username : dwintheiser

- bio : Omnis impedit quod aspernatur eligendi id in voluptas. Ut voluptatem assumenda perferendis natus doloribus aliquid minima. Ea eum facilis tempore itaque vel.

- followers : 5139

- following : 1143